Capital B – Who Owns Berlin is probably the best documentary about a city any city out there, in a league all of its own with Los Angeles Plays Itself.

What happened to one of the biggest cities in continental Europe? A city that had incredible opportunities, cheap basically free spaces for grabs, and immense swaths that were opened up after the fall of the Berlin Wall. Berlin was probably the biggest story in subcultural history. This documentary by Arte Channel in 5 parts explains it all step by step. Yet saying this we cannot forget that after the Wall, there were winners and losers of the reunification, and sadly the losers (in economic terms, in job and academic positions, and cultural management positions) – were the people of former East Germany or DDR who today are being swiped off their feet by populist rhetoric and vote for the extreme right-wing AfD demagogues (altough there have been huge protests against AfD recently against right-wing extremism and for democracy).

Important to mention here that the institution (Treuhand), the pop-up trust company seated in Berlin that regulated and controlled the restructuring from a planned to a market economy did this almost overnight, without much accountability or democratic supervision. Its task was certainly immense to privatize 8,000 formerly nationally-owned enterprises. Modernizing thousands of enterprises and closing down thousands of others, from gigantic combines comprising a staff of umpteen thousand up to small family enterprises – and it ended with complete humiliation for East Germans, even if some say there were some benefits.

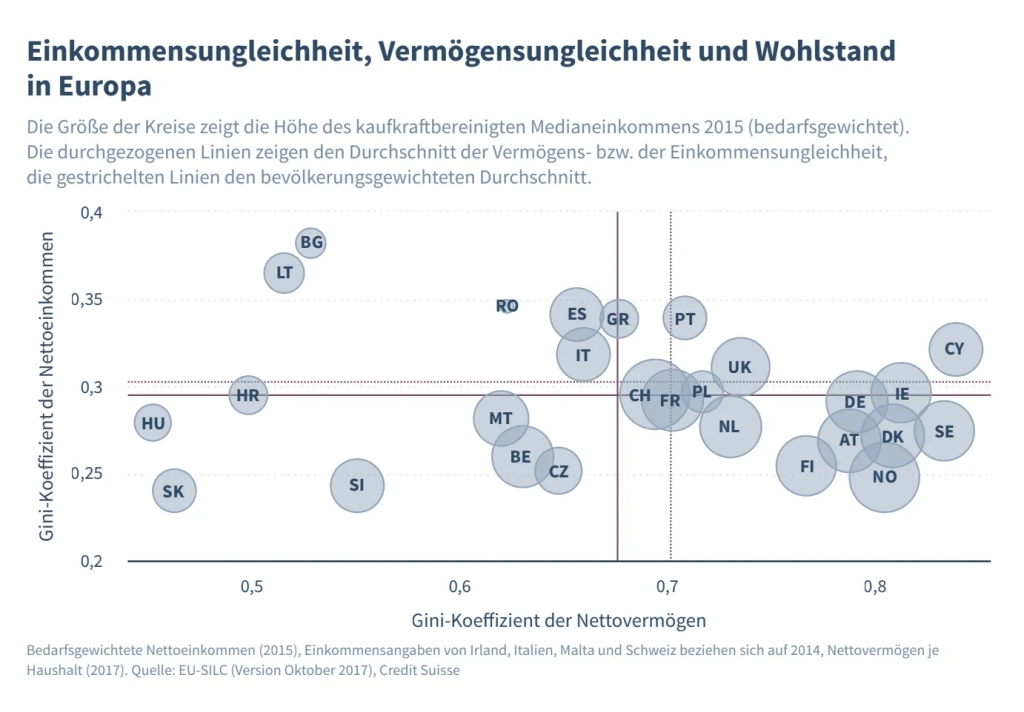

I think the story in Berlin is even starker, for most Berliners, and for most that have been living to see the explosion in subcultural spaces, clubs, and underground venues – it all came with a huge cost, they all were just acting like a magnet for the real estate mafia. Real estate – and space (to use Jameson’s suggestive quote from below) one might say is at the center of today’s capitalism. It was involved in the sub-prime crisis in the US that spread throughout the whole world, and certainly in land grabs around the world as well as ‘zoning’ of special economic zones, duty-free areas, and offshore tax-free heavens.

To narrow it down to a city – Berlin, the German capital allows us to see this process of capital accumulation, rent extraction, and speculative markets. It is a very sad documentary, particularly harrowing for all those who went through 30 years of gentrification and speculative luxury housing investments. Sadly the 5 part documentary is only available in French and German, there are no English subs, but I sincerely think someone who cares about the history of this city should do it, especially considering how many EN-speaking inhabitants live in this city.

There is interviews with key figures of the underground but also mayors, investors, politicians etc. The documentary offers a unique range of voices and key figures who were deeply and personally involved in shaping this city and transforming it into what it has become today. This is also the story of techno music and its entry into German electronic music. It is about the translation of a metronomic abstract heavy beat arriving in Berlin from Detroit Motor City via the UK and Belgium and one of the first musical styles to unite both East and West. Techno pioneers from East and West Berlin started setting the night on fire. It is really important to see how the members of the initially small rave culture tribe started scouting for a location, and how they ended up finding TRESOR by chance, that incredible space initially situated on Leipziger Straße and cleaning it and there is incredible VHS footage of that moment in 1991. Subculture had its summer of anarchy, an incredible mix of utopia and frenetic living, but the power elites of the city started asserting their pressure – and it all ended with fierce police raids, street battles, and forced evacuations.

One should understand that this is a battle to the teeth, in the middle of the 1990s the West Berlin old-money elites got their interests served by mayor Eberhard Diepge – and started exercising their stranglehold over the city. Klaus-Rüdiger Landowsky one of the most powerful figures in Germany and together with Diepge want to transform Berlin from an industrial hub into a financial capital of the world on par with London and Frankfurt. It all ends with the biggest banking scandal in Germany and the arrival of a new younger mayor ready to use the power vacuum: Klaus Wowereit. Districts such as Kreuzberg and Wedding with a big migrant population are being transformed into virtual ghetto’s without opportunities, high unemployment rates and lack of funding. Savas Yurderi aka Kool Sava becames one of the most well-known rappers in Germany and he’s speaking with the voice of that place.

This is the final decade where clubs get closed, everyone is kicked out and most of the underground places get shut down. It is the march of uberization, digitial nomadism and finacial speculation.